Enjoy more ways to keep your OTPs more private and your transactions more secure!

As an RCBC customer, you can now choose to receive your One-Time PIN (OTP) via the RCBC Digital app in order to validate your online transactions, as an alternative to SMS messages.

With this new feature, instead of receiving an SMS message through your registered mobile number, a push notification containing your OTP will be delivered to your registered primary device where your RCBC Digital app is installed.

Ready to start receiving your OTP via app?

Activate this feature by following the instructions below.

Here's how:

If you have not enrolled your account in RCBC Digital yet:

Step 1:

Download the RCBC Digital App

Step 2:

Enroll your existing RCBC account

Once you've enrolled your account:

Step 3:

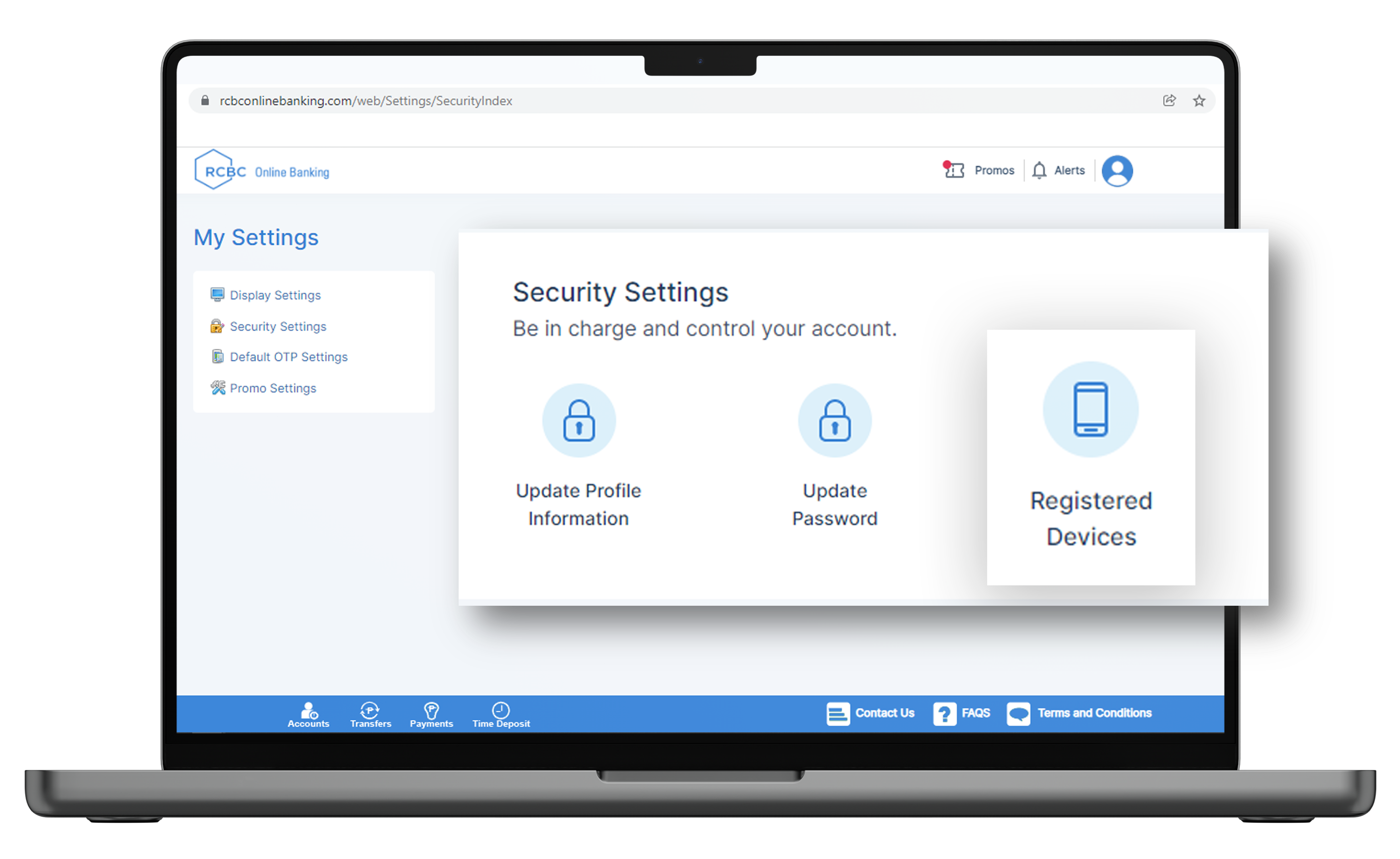

Log on to the RCBC Digital website

Step 4:

Go to Settings > Security Settings > Registered Devices

Step 5:

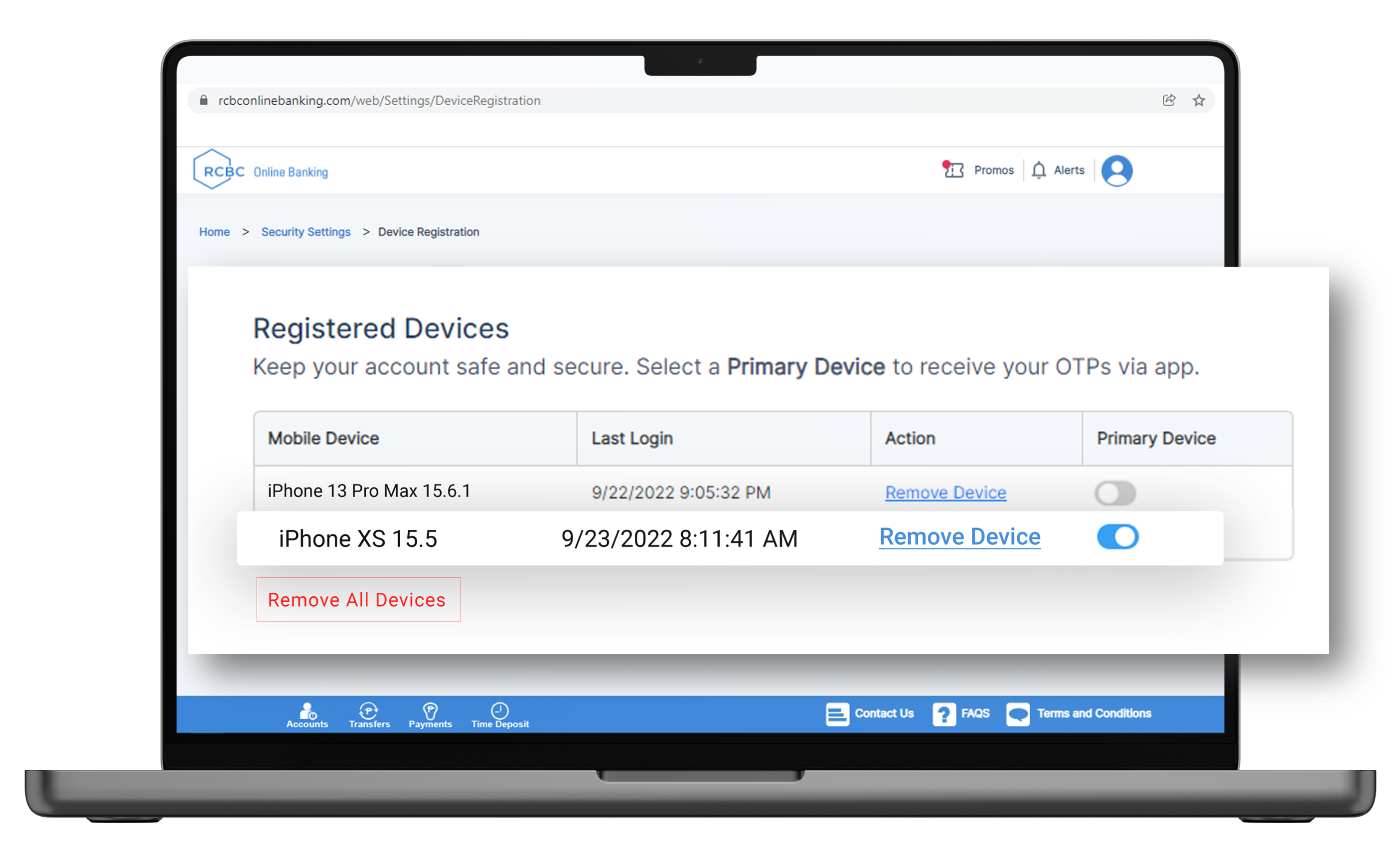

Select the device you'd like to authorize to receive the OTP

Frequently Asked Questions

- Can I receive my OTP for a single transaction both via SMS and via app?

No, you may only choose one method of receiving your OTP per transaction: either via SMS or via app.

- Where will I receive my OTP via app? (If multiple mobile devices with RCBC Digital app)

Your OTP will be delivered to your registered primary device. You can nominate your primary device by logging on to the RCBC Digital website and updating your ‘Security Settings’ under ‘My Settings’.

- Does OTP via app apply to web-based or desktop-based transactions?

Yes, OTP via app applies to all types of online transactions, whether done via mobile or desktop.

- Can I receive my OTP through the RCBC Digital website?

No, OTP via app is only available through the RCBC Digital app installed on your mobile device. You may download the app via Google Play or App Store.

- Can I choose OTP via app as my default channel for OTP?

Yes, you may set your mobile app as the default channel for OTP by logging on to the RCBC Digital website and updating your ‘Default OTP Settings’ under ‘My Settings’.