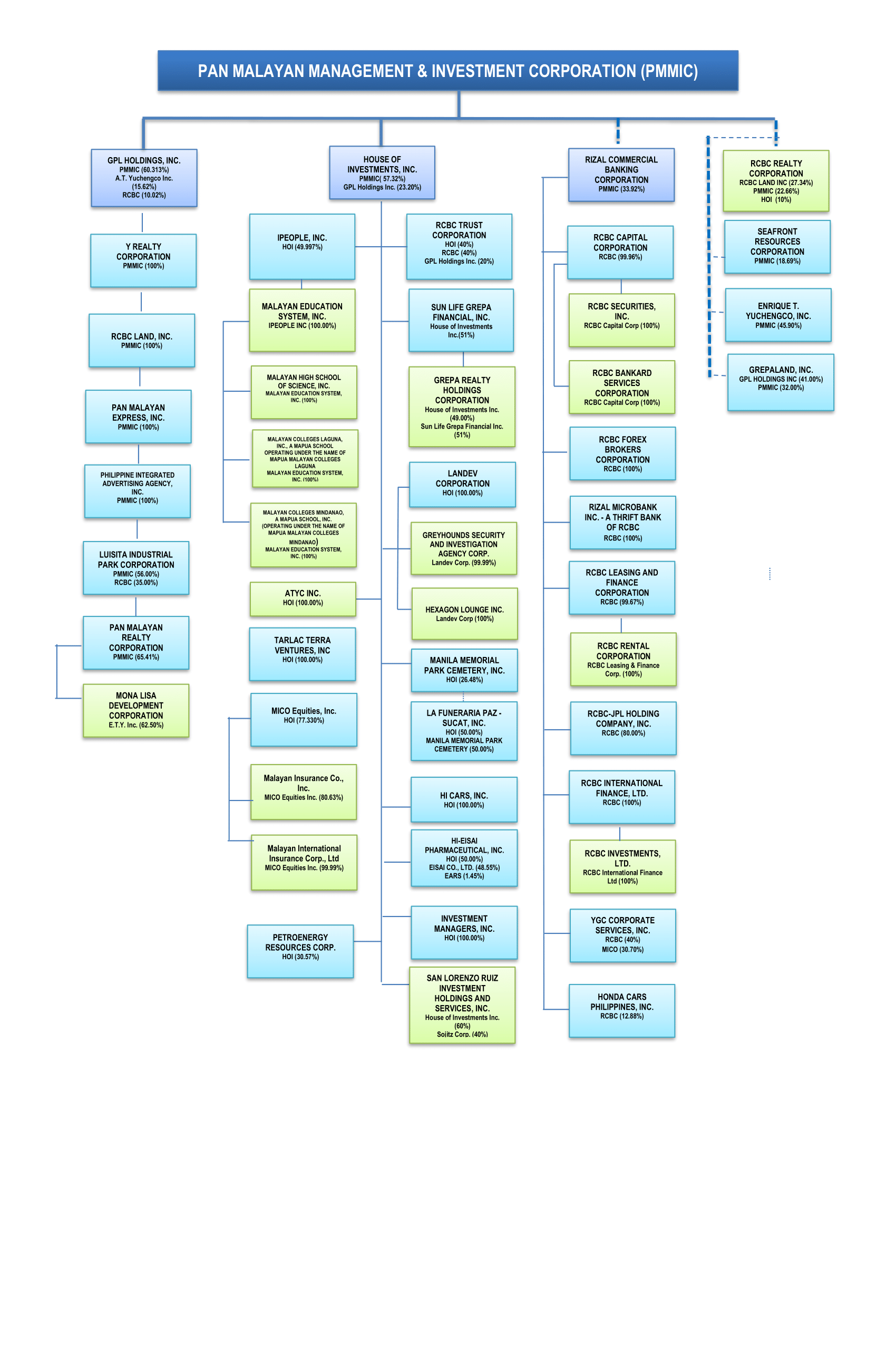

Rizal Commercial Banking Corporation (RCBC) is the 5th largest privately owned universal bank in the Philippines, with over Php1.3 trillion in total assets as of March 31, 2025.

For over 60 years, RCBC has been building a reputation for providing the best customer experience, award-winning digital banking services, and pioneering innovations. The Bank offers a wide range of banking and financial products and services to cater to diverse customer segments. It provides consumer, commercial and corporate lending products, deposits and cash management solutions, treasury products, remittance services, and mobile banking services.

RCBC and its nine subsidiaries also offer traditional banking, investment banking, retail financing (auto, mortgage/housing loans, credit cards and microfinance loans), remittance, leasing, foreign exchange and stock brokering.

Customers

RCBC drives customer acquisition across various retail segments and corporate accounts of all sizes. It is also a favored digital banking brand.

Apart from credit or lending products, the Bank also has a full range of cash management solutions and other corporate services such as escrow and loan agency to address the various requirements of corporates which include top 1,000 corporations, emerging conglomerates, and Chinese markets. As the first local bank to establish a Japan Desk, its dealings with Japanese companies are some of the most extensive of any local bank.

Through its microfinance arm, Rizal Microbank, RCBC is able to address the requirements of microenterprise and small business operators, as well as value chain players particularly in the agricultural sector. Rizal Microbank operates in key areas in Luzon, Visayas, and Mindanao with a network of 18 branches.

Aligning with its commitment to reach more unbanked Filipinos, RCBC introduced DiskarTech in 2021, the Philippines' pioneering Tagalog-English financial inclusion "super app". This innovation aims to enhance accessibility for Filipinos residing in remote areas and grassroots communities. Notably, the app has already recorded a total of over 6 million downloads, reflecting its positive impact.

In the retail space, RCBC boasts of some of the most comprehensive product suites. From the high net worth and affluent customers, to the underbanked, RCBC has developed a set of solutions to address each of these segments’ unique requirements.

Delivery Channels

RCBC has extensive delivery channels to better serve its growing customer base.

As of March 31, 2025, it has:

- an extensive network of 469 branches

- 1,468 ATMs

- 5,855 ATM Go terminals with presence across all 82 provinces of the country

- Internet and mobile banking (IOS and Android applications)

Industry Awards & Recognition

A pioneer in financial services, RCBC continues to garner significant recognition for its innovation and commitment to customer experience. The Bank recently achieved a Five-Peat as Best Bank for Digital at the prestigious Euromoney Awards, a testament to its sustained leadership in digital banking. Further highlighting its innovative spirit, RCBC was the Sole Philippine winner of the Sustainable Innovator Award at the Singapore FinTech Festival (SFF) FinTech Excellence Awards 2024.

Beyond digital prowess, RCBC has been recognized for its exceptional customer focus, earning the titles of Best Customer Experience Bank (Philippines) at the International Finance Awards 2024 and Best in Future of Customer Experience at the IDC Future Enterprise Awards 2024. The bank's dedication to engagement was also celebrated with a Gold award for Maximizing Customer Engagement at the Infosys Finacle Innovation Awards.