Bayanihan to Recover as One Act

With reference to BSP Memorandum No. M-2020-074: Implementing Rules and Regulations (Rules) and Frequently Asked Questions (FAQ) on Section 4(uu) of the R.A. No. 11494 or the “Bayanihan to Recover As One Act”, please be guided as follows:

1. What is Bayanihan to Recover As One Act (BARO) and how does it apply to me as borrower?

The Bayanihan to Recover As One Act is a law that aims to assist Filipinos during these uncertain times. The BARO requires all Bangko Sentral Supervised Financial Institutions (BSFIs) with lending operations to implement a mandatory one-time sixty (60) day grace period to all existing, current and outstanding loans.

RCBC is a BSFI and will be complying with this.

2. Who are entitled for the mandatory 60-day grace period?

Only borrowers whose accounts are in current status as of September 15, 2020 are entitled for the mandatory 60-day grace period.

3. How will the 60-day grace period under the BARO Act be applied?

It is one-time and non-extendible 60-day grace period for current and existing accounts with due dates falling from September 15, 2020 until December 31, 2020.

There will be no interest on interest, penalties or other charges but “accrued interest” for 60 days will be charged based on the outstanding principal balance of your loan at the time you applied for the 60-day grace period.

In applying the 60-day grace period, the remaining term of the loan will be extended by two (2) months.

Payment of regular amortization will resume on the next due date after the applied 60-day grace period.

4. Can I choose when to avail or apply for the 60-day grace period?

Yes. You can choose from any of your due dates starting from September 15, 2020, October, November and December 2020, which you want to apply for the 60-day grace period.

5. When should I pay the “accrued interest” mentioned above?

It depends when you will apply for the 60-day grace period.

For borrowers who applied for the 60-day grace period on their due dates falling on September or October 2020, accrued interest shall be paid not later than December 31, 2020.

For borrowers who applied for the 60-day grace period on their due dates falling on November or December 2020, accrued interest shall be paid not later than February 28, 2021.

6. Can I decide not to apply for the 60-day grace period?

Yes, you may decide not apply for the 60-days period to keep the original term of your loan and avoid payment of “accrued interest” mentioned above.

You have to notify or inform RCBC of your decision on whether to apply or not for the 60-day grace period.

7. How can I notify or inform RCBC of my decision on whether to apply or not for the 60-day grace period?

RCBC will post an advisory in its website and Facebook page showing the online link that will be live for one month where only qualified and verified borrowers can access to guide them in making their decision on the application of the 60-day grace period.

The qualified borrowers will also receive a text message for the email address and contact numbers of the dedicated team that will record and handle the details of their decision regarding the 60-day grace period.

8. What will happen to my account if I did not or fail to access the online link or was not able to inform RCBC of my decision on whether to apply or not for the 60-day grace period?

Considered as to HAVE APPLIED for the 60-day grace period

For borrowers who did not or failed to access the online link and whose numbers are uncontactable, without existing emails on record and have insufficient funds in their accounts enrolled under auto-debit arrangement, they will be considered to have applied for the 60-day grace period on their due date falling within the one month period the online link was live or accessible.

Considered as to NOT HAVE APPLIED for the 60-day grace period

For borrowers who did not or failed to access the online link while it is live or accessible but whose numbers are contactable or with existing emails on record, and have sufficient funds in their accounts or without history of default since their loan application, they will be considered to have not applied for the 60-day grace period. As long as their accounts are sufficiently funded and they are not informing or notifying RCBC that they will avail the 60-day grace period after the expiry of the online link and before December 21, 2020 when they received text messages or emails reminding them of their regular amortizations and due dates, they will be continuously considered as to have not applied for the 60-day grace period.

For borrowers who did not or failed to access the online link while it is live or accessible or inform RCBC thru any other means of notification and whose numbers are uncontactable or without existing emails on record, but with sufficient funds in their accounts enrolled under auto-debit arrangement or have no history of default since their loan application up to December 31, 2020, they will be considered to have not applied for the 60-day grace period.

9. What will happen to my auto debit arrangement or post-dated checks after notice of my decision thru the online link, text message, emails, and other forms of notification, or if I failed to inform RCBC on whether to apply or not for 60-day grace period?

You will have one month to access our online link after it goes live, or 10 days before your next due date to reply to our text message or email, or until December 31, 2020 to reach us through other means of communication, to decide on whether to apply or not for the 60-day grace period.

For borrowers who did not apply or were considered to have not applied for the 60-day grace period as mentioned under FAQ No. 8, their auto-debit arrangement and clearing of post-dated checks will continue.

For borrowers who applied or were considered to have applied for the 60-day grace period under FAQ No. 8, they will receive an email or text message that their decision was recorded for implementation and their auto-debit arrangement will be lifted or clearing of post-dated check deferred accordingly. Also, they will receive another notice or reminder within a month on the resumption of their regular monthly amortization on their next due date and chosen or agreed payment of accrued interest (AI).

We encourage that you notify or inform us of your decision to apply for 60-day grace period within 10 days before your next due date after you have accessed our online link, received our text message or email, or reached us by other means, to avoid any delay in the reconciliation of your auto debit or PDC arrangement with us.

Read full BSP memo hereUpdates on the R.A 11494 or the "Bayanihan to Recover As One Act"

In compliance with the Bayanihan to Recover As One Act (BARO Act), qualified clients are entitled to a one-time 60-day grace period for their RCBC loan. Clients can choose to apply this non-extendible grace period for current and existing accounts with due dates falling from September 15 until December 31, 2020.

Read full BSP advisory hereBRANCH ADVISORY - March 29 to 31, 2021

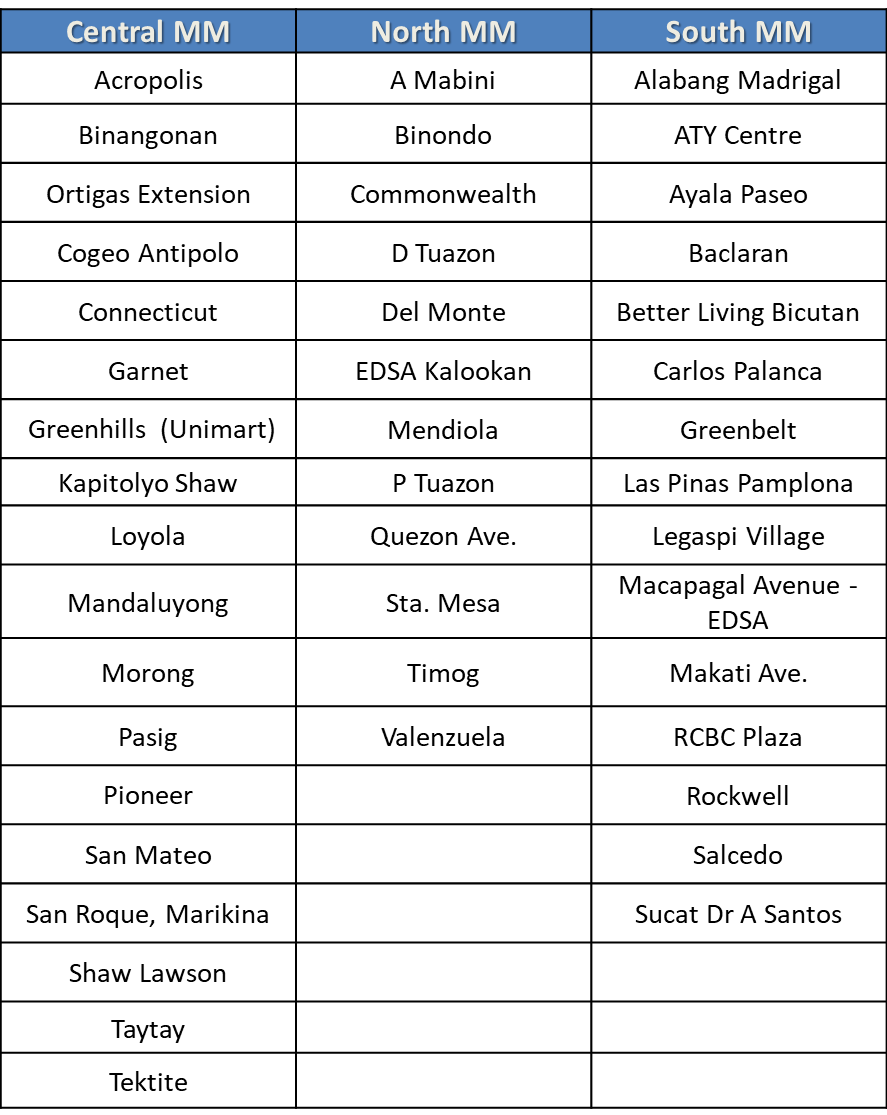

Select Metro Manila and Rizal Branches open from March 29 to 31 with shortened banking hours:

Go to Branch Finder